Have you ever wondered if a chatbot could actually help you manage your money? With AI-powered chatbots becoming smarter every day, they are now being used in financial services to help people track their spending, save better, and even invest. But how effective are they? Can they really understand your unique financial situation? Let’s explore this in a simple and engaging way.

How AI Chatbots Are Changing Financial Services

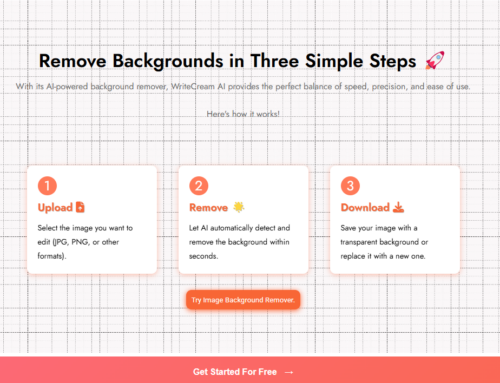

Imagine you are trying to check your bank balance late at night, but customer support is unavailable. Instead of waiting for hours, an AI chatbot steps in to assist you immediately. AI chatbots for financial services are transforming the banking industry by providing round-the-clock customer support. These chatbots offer instant responses, handle customer questions efficiently, and improve customer service. Financial institutions are now relying on banking chatbots to enhance customer interactions and deliver seamless financial advice.

Not just that, AI chatbots are revolutionizing the financial sector by simplifying financial operations. Chatbots can help users understand complex products and services, guiding them through the process without any hassle. With the power of machine learning and generative AI, chatbots in banking are becoming more intuitive, making customer engagement more personalized. Specifically for financial institutions, a conversational AI platform can improve customer satisfaction by tailoring solutions that fit individual needs. AI chatbots provide a smarter way to manage money, ensuring customer experience is smooth and hassle-free.

How can conversational AI guide users in managing their personal finances?

Managing money is not easy. Many of us struggle with keeping track of our expenses, setting aside savings, or planning for big financial goals. This is where AI chatbots can help. These smart assistants can provide real-time insights based on your spending habits, remind you to save, and even warn you when you’re overspending.

Here’s what James Hacking, Founder and Chief Playmaker of Socially Powerful, has to say about it:

“Conversational AI can guide users in managing personal finances by providing real-time insights tailored to their spending habits and financial goals. By analyzing transaction data, it can identify patterns, flag unnecessary expenses, and suggest adjustments to align with the user’s budget. AI-powered chat interfaces make this process intuitive, allowing users to ask questions like, ‘How much did I spend on dining last month?’ and receive immediate, clear answers.

Beyond tracking, conversational AI can assist with planning. It can recommend savings strategies, set reminders for bill payments, and simulate different financial scenarios to help users make informed decisions. By combining accessible guidance with personalized recommendations, it empowers users to take control of their finances without needing extensive expertise.”

What are the risks of relying on AI for investment and savings advice?

While AI chatbots can be helpful, they also come with risks. Should you trust a machine to give you financial advice? What if the advice isn’t accurate or doesn’t consider your personal situation? One major concern is data privacy. Financial data is sensitive, and any security breach could be disastrous.

Here’s what Josh Qian, the COO and Co-Founder of Best Online Cabinets, says about the risks:

“Conversational AI can revolutionize personal finance management by providing tailored advice and fostering a more engaging and interactive user experience. AI can act as a financial advisor and coach, offering encouragement and motivation along the way. By integrating elements such as setting savings goals and rewarding progress, AI can make the often daunting task of managing finances feel more approachable and even enjoyable.

While the benefits are numerous, it’s important to be mindful of the risks associated with relying on AI for investment and savings advice. One significant concern is data privacy and security. Users may share sensitive financial information with AI systems, and any data breach could have serious repercussions. The algorithms driving AI recommendations may not be fully transparent, leaving users in the dark about how their advice is generated. The lack of transparency can lead to misplaced trust, where users might follow advice blindly without understanding the underlying rationale.”

Can AI learn to adapt financial advice for users from different economic backgrounds?

Not everyone has the same financial situation. Some people have more money to invest, while others are struggling to save even a little. Can AI recognize these differences and provide advice that makes sense for each person?

Josh Qian shares his thoughts on this:

“Not all users have equal access to technology or financial resources. Someone in a lower-income bracket may not have the same access to investment opportunities as someone from a wealthier background. AI must be designed to recognize these disparities and offer practical, actionable advice that considers the realities of different financial situations. This could include recommending community resources or programs aimed at helping individuals build their financial literacy and capabilities.

Another thing to consider is AI’s psychological impact on personal finance. People often make financial choices based on fear, hope, or societal pressures, and AI may not be equipped to navigate these complex emotions. Therefore, a hybrid approach that combines AI’s analytical abilities with human oversight could be more effective. Financial advisors could use AI tools to enhance their services, ensuring clients receive data-driven insights and empathetic guidance.”

How AI Chatbots for Financial Services Help in Fraud Detection and Prevention

This level of security isn’t just a luxury, it’s becoming a necessity in today’s digital world. With cyber threats increasing, AI chatbots for financial services are playing a bigger role in fraud detection and prevention. Imagine logging into your online banking account and noticing an unfamiliar transaction. Panic sets in, but instead of waiting on hold with customer service, you use the chatbots for banking. The AI-powered chatbot quickly analyzes the transaction and alerts you if it detects fraud. This is how AI chatbots for financial services are transforming security in the banking sector.

AI can help financial institutions by identifying fraud patterns and preventing unauthorized transactions before they happen. These finance AI chatbots for financial services provide real-time monitoring and instant alerts, making fraud detection faster and more efficient. Chatbots in the banking industry are designed to spot unusual spending behavior, ensuring customers’ accounts stay secure. The best chatbots in banking and chatbots for finance are now an essential part of banking services, helping financial institutions safeguard their users. The best AI chatbot for finance not only detects fraud but also assists with personal finance by keeping track of spending habits.

Here’s how AI chatbots for financial services can also enhance fraud prevention:

- Continuous monitoring – Chatbots use natural language to communicate with customers and analyze suspicious activities.

- Instant alerts – AI-powered chatbots notify users immediately about unusual transactions.

- Verification assistance – Chatbots can be used to confirm the legitimacy of transactions in seconds.

- Adaptive learning – The best chatbots in banking improve over time by learning from past fraud cases.

- Customer education – Chatbots include tips on safe banking practices to protect users from scams.

With the future of AI evolving rapidly, looking for the best AI solutions for fraud prevention is crucial. The best AI chatbots for financial services ensures customers feel secure while also improving customer experience and enhancing customer interactions. As finance bots continue to advance, financial products and services will become safer and more efficient for everyone. Banking chatbot technology is making online banking more secure, and AI can be used for various financial tasks beyond fraud detection. The use cases for chatbots in the banking industry are expanding, proving that AI-powered chatbots are a game-changer for financial chatbots and the broader finance industry. By integrating finance, AI chatbots for financial services provide better security, and those looking for the best AI solutions should use the chatbots for an extra layer of protection.

Conclusion

The impact of AI chatbots and virtual assistants for financial services is clear—whether it’s simplifying banking tasks, improving security, or offering instant support, they are transforming the banking and fintech industry. Today’s chatbots don’t just answer basic queries; they provide real-time insights, assist with financial goals, and even offer financial education to help customers make better financial decisions. AI is being used to create smarter solutions, making banking more accessible and efficient.

With the rise of personal finance chatbots and AI-driven automation, banks are now leveraging AI to enhance the overall banking experience. Chatbots can handle complex queries, assist in cross-selling financial products based on the customer’s needs, and even support accounting and finance tasks. Leading international finance organizations and banks using chatbots are seeing major improvements in efficiency. The performance of chatbots is constantly evolving, with innovations like Lyro AI automating processes in the financial sector level. As technology advances, the future of finance artificial intelligence looks promising, making banking more secure, smart, and customer-friendly.